How Does Debt Relief Work?

You may be wondering how debt relief works and how to explore your debt relief choices with Cardinal Law Center if debt is dragging you down and you are ready to be free of all the stress and worry that comes with it.

Investigating your options is a smart move. Here, you may find information about several debt relief choices. You'll learn:

- How can I get debt relief right now?

- What debts are eligible for debt relief programs?

- To get out of credit card debt, explore the following five choices.

- How long does debt relief take to be effective?

- How Does a Balance Transfer Work and What Is It?

- Debt management explains what it is and how it works.

- What is the process of debt negotiation?

- What is the best way to get started with debt relief?

What is Debt Relief?

Here’s some really great news for you. You’ve already taken the first step toward debt relief by reading this. Discovering what you can do to acquire debt relief is a significant step toward long-term success.

The stronger your desire to get out of debt, the more likely you are to take the necessary steps to get out of debt. There are only six stages to getting out of debt.

- Examine your financial circumstances.

- Determine which regions are problematic.

- Recognize how much your debt costs you.

- List and rank your debts in order of importance.

- Make a budgeting plan and select a budgeting system.

- If necessary, get professional assistance and select the best debt relief plan.

Taking efforts to better understand your financial status will help you choose if you need professional debt relief or if you can work your way out of debt by carefully budgeting and practicing strong money management skills.

Programs for Reducing Various Forms of Debt

When you need debt assistance, you may wish to combine all of your debt into one large bucket and try to manage it that way. The difficulty with this strategy is that debt reduction programs aren’t built to deal with all sorts of debt.

Unsecured debt and secured debt are the two main categories of debt. Secured debt is debt that is linked to an asset, such as your car or your home, in some way. Creditors often have the power to seize the asset that secures the loan if you miss payments on secured debt.

Unsecured debt differs from secured debt in that it is not secured by any physical asset. If you miss payments on unsecured debts, creditors may find it difficult to collect. Because of the increased risk to the lender, unsecured loans have higher interest rates than secured loans.

| Unsecured Debt | Secured Debt |

| Credit Card Debt | Vehicle Debt |

| Personal Loan | Mortgage Loan |

| Private Student Loan | Some Federal Student Loans |

Credit card debt is the most prevalent sort of debt that is addressed through a debt relief program. This is most likely due to the fact that the United States owes $830 billion in credit card debt, a figure that has been continuously rising for some time. Credit card debt has grown too much for many families to bear on their own.

How to Get Out of Credit Card Debt: Five Alternatives to Consider

What alternatives do you have if you've concluded that debt relief is in your near future? Here are five possibilities to think about:

- Loans for debt consolidation

- Transfers of funds

- Plans for debt management

- Bankruptcy

- Planned debt repayment

Each of these debt relief alternatives is ideal for specific situations, so it’s worth looking into which one will be the most beneficial to you. Let’s take a look at each one to see which one best suits your needs. But first, you’ll probably want to ask one last inquiry.

How much time does it take to pay off debt?

The length of time it takes to pay off debt is determined by a number of factors, including but not limited to:

-

- Whichever debt relief solution you select

- The degree to which you follow the

- program you select

- The amount of debt you owe

In general, it will take you anywhere from 2 to 5 years to become entirely debt-free.

To see how much you can save, get a free savings estimate today.

How Does a Debt Consolidation Loan Work?

Consolidating debt is exactly what it sounds like. Consolidating your debt, or rolling all of your debt into a single responsibility, is what it means. It’s a strategy to simplify your debt rather than eliminate it.

If you have a good credit score, you might be able to receive a debt consolidation loan with a low, fixed rate that will end up costing you less in the long term than the variable-rate credit cards you’re presently using, which may have a higher interest rate.

It is crucial to realize, however, that not everyone is eligible for a low-interest debt consolidation loan. In some situations, taking out a debt consolidation loan may end up costing you more money in the long run.

Another risk associated with debt consolidation loans is that they may be secured. Some consumers prefer a secured loan because it offers a cheaper interest rate than their present credit cards. They are, however, securing the loan with their home or automobile in this procedure. What occurs when people are late with their payments? Then their car or home may be taken away from them.

Debt consolidation loans are often only suggested for persons who:

- Have a high credit score.

- Maintain a good debt-to-income ratio.

- Have a strong desire to improve their spending patterns and remain debt-free once their initial debt is paid off.

Pros of Debt Consolidation

Cons of Debt Consolidation

- Debt repayment is made easier.

- Reduced interest allows for monthly savings.

- Removes high-interest, variable-rate debt.

- For the best rates, you must have a high credit score.

- It's possible that the loan will be secured, which raises the danger of losing additional assets.

- To avoid overspending, you'll need a lot of willpower.

How Does a Balance Transfer Work?

If you don’t want to take the risk of acquiring a secured loan to consolidate your debt, you can consider a credit card balance transfer instead.

Here’s what you need to know about debt consolidation and balance transfers. Using a debt transfer is essentially the same as paying off one credit card with another. So, in the end, you’ll have to deal with the greater issue of how to practice good financial discipline in order to make a balance transfer truly beneficial.

However, there are rare instances where a balance transfer may be beneficial. For a balance transfer to be a good deal for debt relief, the following conditions must be met:

-

-

You must be eligible for a balance transfer. (This isn’t true for everyone.)

-

You’ll need to discover a balance transfer card with a lower interest rate than the one you have now. (If at all possible, look for one with a 0% interest rate.)

-

You must locate a credit card with a payment that you can afford.

-

A balance transfer may be an option for you if you can find a card that fits those requirements. Here’s an example of how a balance transfer might function in practice.

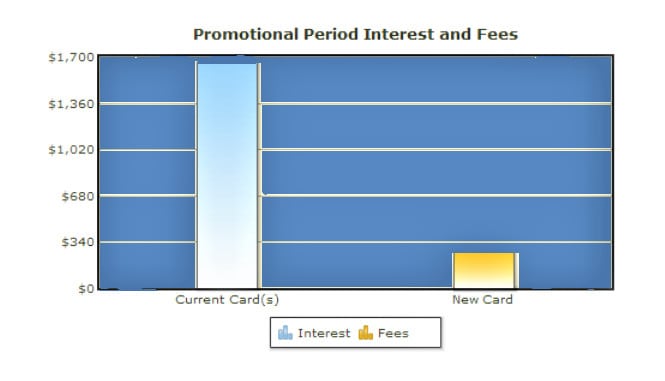

Assume you have two credit cards in your wallet. You owe $5,000 on card one, and your APR is 16.49 percent. You owe $4,500 on card two, with an APR of 18.49 percent. You have exceptional credit and discover a debt transfer deal with a 12-month promotional APR of 0% and a 16.49 percent APR thereafter. A 3% transfer fee will be charged upfront by the card company. Is this a reasonable price?

(Source: Motley Fool)

You can save an additional $1,372 over the next 12 months by moving your credit card balances and not charging anything more to your credit cards, and then save $7 per month after the introductory period ends.

Isn’t that appealing? It is, with one stipulation. It only works this way if you don’t use your credit cards for purchases or cash advances any longer.

This balance transfer option may help you get out of debt if you can entirely cease using your credit cards for purchases. However, it has no effect on the total amount you owe. It may simply assist you in repaying your debt by lowering the amount of interest you pay over time.

Debt Management: What Is It and How Does It Work?

Debt management, often known as credit counseling, is another debt relief option to consider. You engage with a credit counseling service to get out of debt via debt management. In essence, you take over debt management to a credit counseling organization, which then deals directly with your creditors.

Your debts are consolidated into a single, lower-cost bundle by the credit counseling firm, with the goal of obtaining lower interest rates and penalty forgiveness from your creditors. This debt relief strategy does not save you any money in principal payments because the credit counseling firm does not work to reduce the principal amount you owe to your creditors.

Unlike a debt consolidation loan, however, this kind of debt relief does not necessitate a high credit score, making it more accessible to a wider range of people.

You will be working under a debt management plan if you deal with a credit counseling service (DMP). Your DMP payment is usually not much less than what you are presently paying to your creditors, but because your interest rates are likely to be lower than previously, In four or five years, you ought to be able to settle your debts.

Pros of DMPs

Con's of DMPs

- Interest rates and fees have been reduced.

- There is no requirement for excellent credit.

- Your credit score will be affected in a little way.

- Fees must be paid up front as well as on a monthly basis.

- For the length of the program, you will not be able to open new lines of credit.

- Until the program is completed successfully, no debts are completely discharged.

Keep in mind that the credit counseling service you engage with will not negotiate with your creditors to lower your principle balance. Only if the following statements are true are debt management programs a smart idea:

- You’re merely attempting to eliminate credit card debt.

- You are ineligible for any other types of debt relief.

- You make enough money and are disciplined enough to pay your DMP on time each month.

How Does Bankruptcy Work?

Bankruptcy is a debt relief option for people in desperate financial situations. The goal of bankruptcy is to provide a fresh start for someone in a hopeless financial condition. Depending on the form of bankruptcy you file, you may be able to repay a portion of your debt or have your obligations erased entirely.

In every situation, bankruptcy comes with a hefty price tag and a slew of restrictions. In most cases, bankruptcy is only an option if:

- You owe a lot of money and have no way of repaying it.

- You are in danger of losing your home due to missed mortgage payments.

- Collectors are putting pressure on you.

- You will not be able to budget your way out of debt.

- You’ve tried everything else to get out of debt.

Because bankruptcy is a harsh way of debt relief that has long-term negative consequences for your credit, it should be used only as a last choice.

How Does Debt Settlement Work?

is a debt relief option that entails negotiating a debt reduction plan with your creditors. It differs from a debt management plan in that you continue to pay your creditors the entire amount of your debt with debt management. Debt settlement, on the other hand, involves your creditors agreeing to accept a lower payment than you owe them.

You could be perplexed as to why creditors would agree to accept less than you owe. The basic explanation is that when a person is having serious financial difficulties and is having issues paying their payments, creditors are well aware that if the person declares bankruptcy, they may not be able to recoup any money. So, in order to avoid losing all of their money, your creditors may be ready to negotiate a settlement to ensure that they get at least some of it back.

That isn’t to imply creditors are going to take this decision lightly. As a result, the majority of people who decide to undertake debt settlement do so with the assistance of a debt settlement firm that specializes in negotiating with creditors on their behalf.

The following is how it works:

Call 888-254-3702 to speak with a cardinal law center Certified Debt Specialist. During that quick phone call, your debt professional will learn about your specific debt position and discuss your debt settlement choices with you. You will receive a savings estimate and a personalized debt settlement plan to consider if it appears to be a good fit.

Once you’ve decided which plan is best for you, you’ll open an escrow account and begin making payments to it. Our professional negotiators begin the process of negotiating with your creditors after sufficient cash have gathered in your escrow account. And there are no upfront costs associated with any of this.

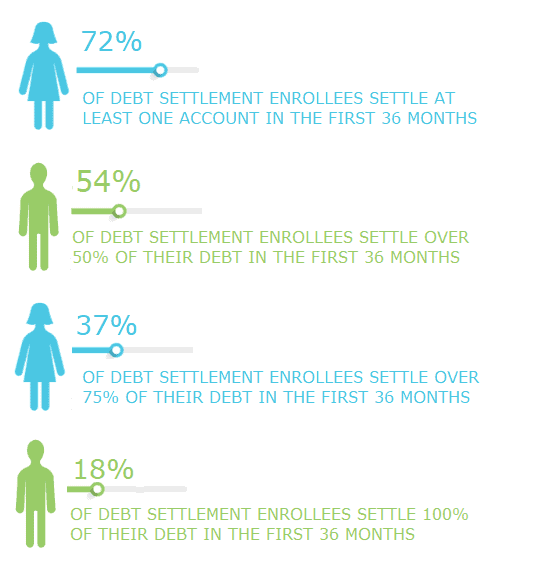

Debt settlement does work, despite the fact that it may appear to be too good to be true. According to a 2020 analysis commissioned by the American Fair Credit Counsel, overall debt settlement program savings average just under $5,800 after costs, and people gain an average of $2.67 in debt reduction for every $1.00 spent on debt settlement expenses. The following figures about debt settlement program success rates were also presented in the report:

Other than bankruptcy, debt settlement is the only debt relief option that allows you to pay less than you owe in order to get out of debt. If you’re drowning in debt, it’s a good idea to look into debt settlement as a possible solution.

How to Get Started with Debt Relief

What should you do now that you’ve learned about your debt reduction options? Why not speak with a Certified Debt Specialist who can answer your questions, review your specific circumstances, and create a personalized plan to help you get out of debt in as little as 24-60 months? To get a free savings estimate, call 888-254-3702 today.

The material supplied is strictly for educational purposes and does not constitute legal or financial advice. Cardinal Law Center is neither a lender, a credit repair organization, or a consumer credit counseling firm. The Cardinal Law Center does not offer financial, tax, or legal advice. Individual credit and loan advice should be sought from a professional financial counselor. For additional information on bankruptcy, please contact a bankruptcy attorney.

Begin Your Personalized Debt Relief Plan Right Now!

I appreciate all of your assistance in resolving my debt, and I've been speaking Cardinal Law Center's praises since the beginning. You guys have gone above and above my expectations, and I've already referred you to a few others I know. Thank you very much for everything!