What is Debt Settlement?

If you’re like millions of other Americans who are drowning in credit card debt, you may feel as if your life has spun out of control. You may regain control by looking into credit card relief possibilities. Debt settlement is an excellent option to consider.

What is Debt Settlement?

Debt settlement is a debt relief option that entails negotiating a debt reduction plan with your creditors. Cardinal Law Center will work with your credit card companies to get them to accept a payment that is less than what you owe and consider your debt to be paid in whole.

Debt settlement, also known as debt resolution or debt reduction, is not a loan or a type of bankruptcy. It’s an arrangement between you and your creditors to lower the amount you owe.

Some people who choose this credit card debt reduction option find their debt reduced by up to 50% before costs.

What is the process of debt settlement?

When you decide to pursue debt settlement, you’ll probably want to deal with a firm that specializes in negotiating with creditors on your behalf.

Of course, debt negotiating on your own is a possibility, but it’s not one that most individuals pick. That’s because dealing directly with your creditors needs excellent bargaining skills as well as a significant amount of time, patience, and effort. To accomplish this on your own, you’d have to call each of your creditors individually, negotiate a debt reduction with each creditor separately, and secure a formal agreement from each creditor outlining the details of the settlement.

Working with a reputable debt settlement firm will help you streamline the process and achieve the greatest debt reduction results possible. Cardinal Law Center is an established leader in debt settlement, with a competent team of qualified debt specialists on your side.

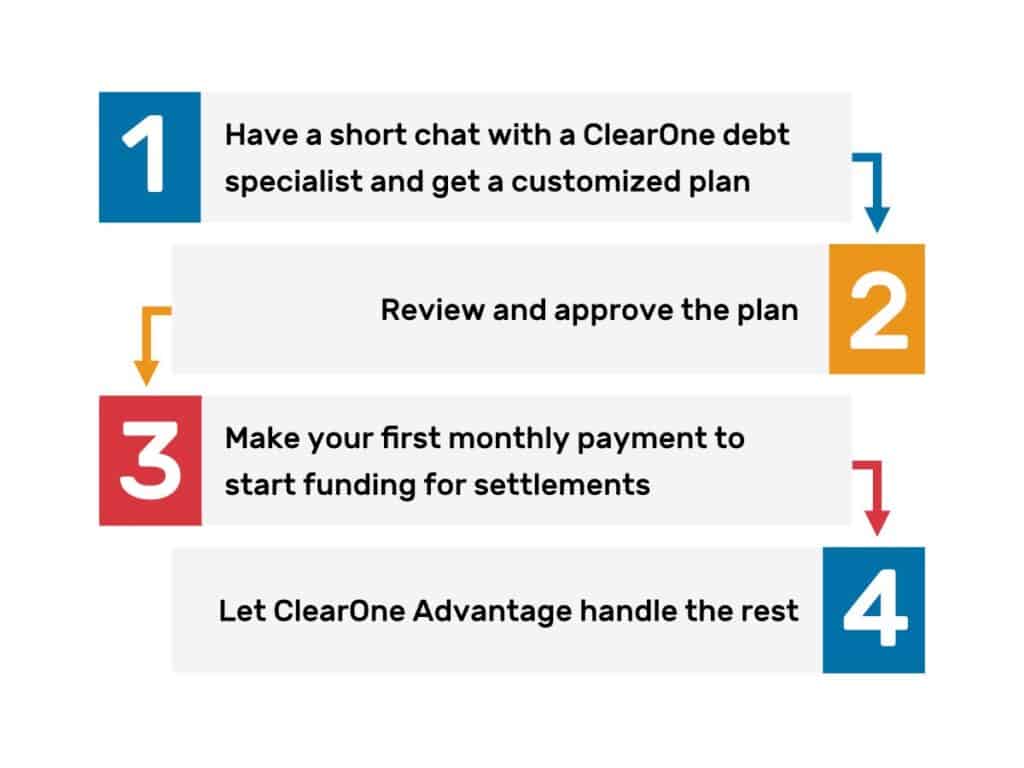

Here’s what to expect when you work with Cardinal Law Center:

# The procedure begins with a free 20-minute consultation with a debt professional who will assess your position and tailor a strategy to your specific requirements.

# You’ll have enough time to go over the plan and approve it.

# You’ll start making deposits into an escrow account that’s FDIC-insured and under your control.

# Once you have enough money in your escrow account, Cardinal Law Center will contact your creditors to start the debt settlement process.

Defeat Your Debt the Smart Way

Get control and start living again.

Why would creditors accept anything less than the full amount owing to them?

While creditors are not quick to accept less than is owed and call it even, it is in the creditor’s best interests to accept what you can fairly give rather than risk receiving nothing at all.

When your debt specialist informs your creditors that there are limited funds available to address your debt, many creditors will understand that they are now competing with other creditors for those money. Negotiating a lower payment will allow a creditor to recoup a piece of the debt while also allowing you to find financial relief.

There are a variety of alternative debt relief methods available, including:

# Credit Guidance

# Loans to Consolidate Debts

# Bankruptcy under Chapter 7

# Bankruptcy under Chapter 13

Here’s a quick rundown of some of the things to think about while choosing a debt relief option.

What are the advantages and disadvantages of debt settlement over alternative debt relief options?

| Debt Settlement | Credit Counseling | Debt Consolidation Loan | Bankruptcy | |

| Credit Score | No minimum | No minimum | Generally above 600 | No minimum |

| Qualifications | $10,000 in unsecured debt | $2,500 in unsecured debt | $5,000 in unsecured debt, good credit | Must document income, expenses and assets to court to prove you are unable to pay your debts |

| Upfront Fees | $0 | $0 – $50 | Potential origination fees of 1%-5% | Attorney fees of $500 – $3500 |

| Financial Benefits |

Short-term relief with a low monthly payment Long-term relief with reduction in total debt repaid. |

Modest debt relief by lowering interest and fees Average term under 60 months |

May provide a lower monthly payment and the convenience of a single monthly payment. Average terms under 60 months. |

Stops collection procedures Usually allows you to keep primary assets although you may have to forfeit some non-essential assets |

| Credit Impact | Significant, but less impactful than bankruptcy | Low | Low | Severe – lasting 7 to 10 years |

| Other Factors to Consider |

May reduce original debt load by half | Missing a payment can result in the loss of program benefits | Could result in paying more interest over the life of the loan | Irrevocable. Need to be current with tax filing and undergo credit counseling before filing |

The Benefits and Drawbacks of Debt Settlement

Each debt relief strategy has its own set of benefits and drawbacks. When it comes to achieving financial independence, it’s critical to think about all sides of the equation. The following are some of the benefits and drawbacks of debt settlement.

Pros

- A single monthly payment is required for the plan.

- Currently, your minimum credit card payment is much lower.

- There are no upfront costs for the service.

- In as little as 48 months, you may be debt-free.

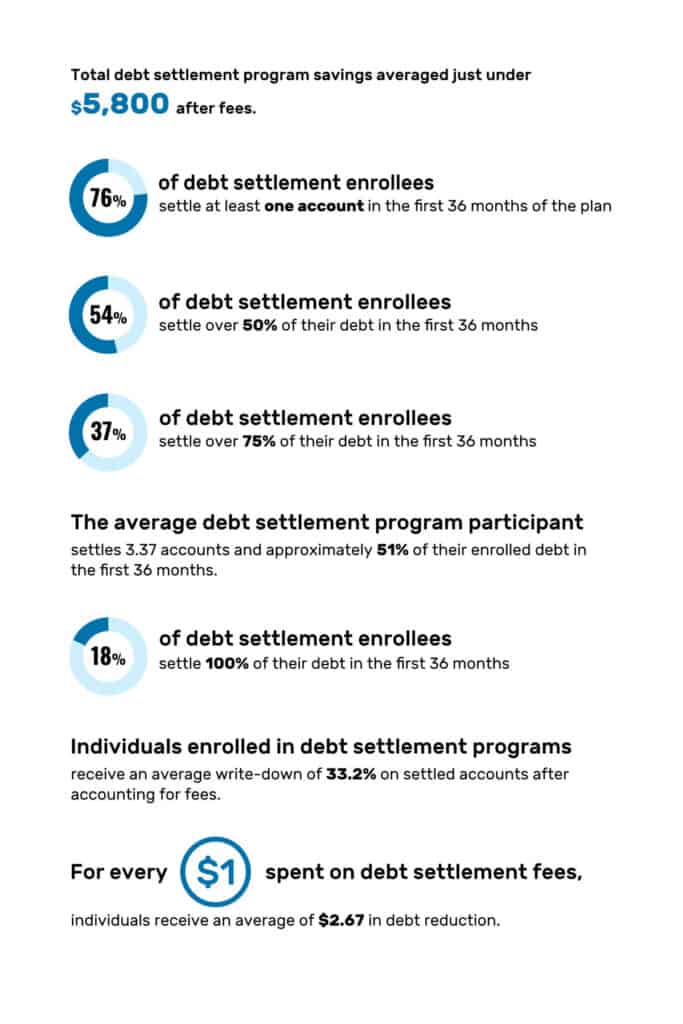

- According to an American Fair Credit Council analysis on the subject, consumers save an average of $2.64 for every $1 spent on debt settlement expenses.

Cons

- Prior to reaching a settlement agreement, creditors may step up their collection operations.

- Some creditors may threaten to take legal action against you.

- Debt settlement has a negative impact on your credit score, although not as much as bankruptcy.

How much money can you save by settling your debts?

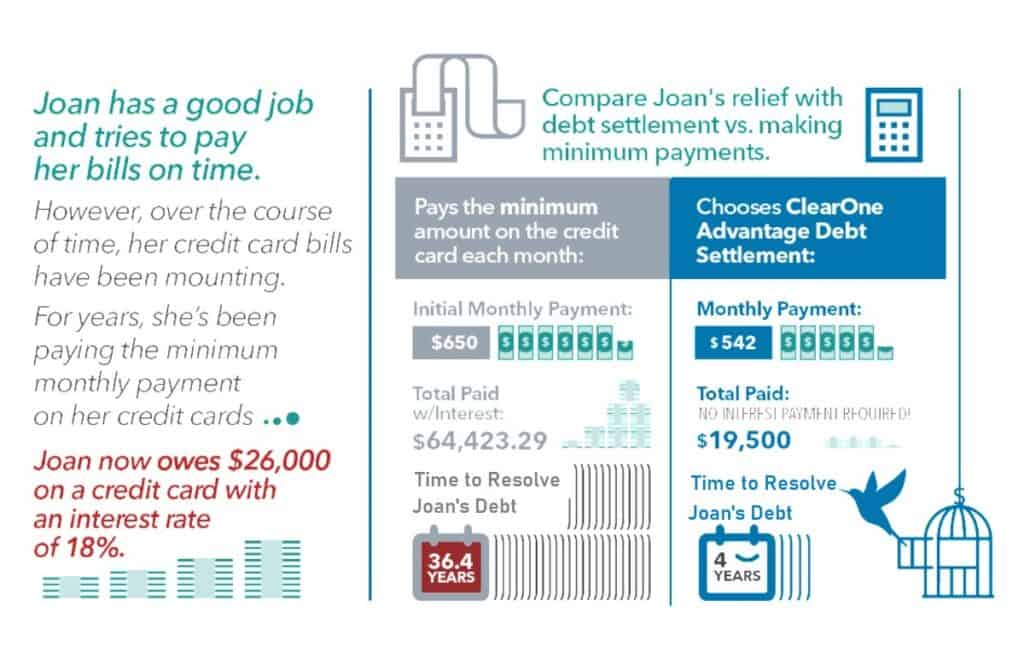

To comprehend the potential savings that Cardinal Law Center debt settlement can provide, you must first comprehend how credit card debt works. Consider Joan’s case as an example.

Why Debt Settlement

Are these figures accurate representations of reality? They are, as these excerpts from a 2020 report commissioned by the American Fair Credit Counsel demonstrate:

Will resolving your debt have an affect on your credit score?

“Yes,” is the straightforward answer. Debt settlement will hurt your credit score, but it won’t be as awful as bankruptcy, which sits on your credit report for seven years.

It’s critical to keep your eyes on the prize when pondering how to get out of crippling credit card debt. While pursuing a debt settlement plan with Cardinal Law Center will have a short-term impact on your credit score, allowing our team of experienced debt specialists to negotiate on your behalf will help you get your finances under control in the long run. Low credit card balances might help you build credit over time.

Even better, consulting with Cardinal Law Center can help you avoid the stress and anxiety that comes with a large debt. We want to see you succeed, and our team is committed to doing all possible to assist you in achieving financial independence and relief.

When selecting a debt settlement firm, what should you look for?

When looking for a debt settlement company, look for one with a proven track record of helping people get out of debt, such as Cardinal Law Center. The Cardinal Law Center (CLC) is an organization

Thousands of consumers who were suffering with overwhelming debt have benefited.

Fees aren’t charged until you’ve examined and accepted a creditor’s settlement offer.

# There is a 100% money-back guarantee.

# Has a dedicated staff of debt professionals and negotiators working for you.

# Is dedicated to equipping you with the skills and resources you need to live a debt-free life.

Allow Cardinal Law Center to assist you in overcoming your debt in a smart manner.

We can assist you if you are dealing with the continual stress and heavy load of out-of-control credit card debt. Cardinal Law Center has the knowledge and skill to assess your financial needs, develop a specialized debt relief plan to meet those needs, and negotiate with creditors on your behalf. Cardinal Law Center has an A+ rating with the Better Business Bureau and has helped thousands of customers who were struggling with debt.

We want you to be debt-free in as little time as possible. We can help you establish a bridge to financial independence by working together. Get out of debt in a wise way. Find out how to do it.

Related Pages

Debt settlement can save you money and, if the benefits and drawbacks are weighed, it may be the best option for some debtors. See if it’s a good fit for you.

You have a variety of debt-resolution choices depending on your financial position. Cardinal Law Center can assist you in determining which choice is best for you.

You are not alone if you are continually concerned about how you will pay your next credit card bill.

Are you interested in learning the truth about debt settlement? In this post, we address a few common misconceptions about credit card debt settlement.

Begin Your Personalized Debt Relief Plan Right Now!

I appreciate all of your assistance in resolving my debt, and I've been speaking Cardinal Law Center's praises since the beginning. You guys have gone above and above my expectations, and I've already referred you to a few others I know. Thank you very much for everything!