Plan for Success

What else can a man with good health, no debt, and a clean conscience add to his happiness?

You must plan for success in order to become debt-free. Debt management necessitates a disciplined strategy. There are no miracle cures. You must make a commitment, adhere to your strategy, and continue. Cardinal Law Center can serve as a solid basis for achieving debt freedom.

Let’s take a closer look at each of these steps.

Step One: Assess Your Financial Situation

Your approach to debt is determined by your existing circumstances. You may have already taken actions to better your financial condition, but understanding where you are now can help you figure out what you need to do to close the difference in wealth between your current situation and where you desire to be.

We recommend speaking with a Cardinal Law Center Certified Debt Specialist if you’re experiencing problems with this or any other part of the process. We’ve assisted thousands of people in developing plans to better their finances and get out of debt, and we can guide you through the process.

Free Debt Relief Savings Estimate

With your tailored plan from Cardinal Law Center, you can see how much you can save each month, as well as an estimate of time savings and overall savings.

Step Two: Identify Trouble Areas

Everyone manages money and finances in their own way, based on their own set of values and attitudes. Some of those views may have been passed down from our parents or other trusted figures in our lives, but when it comes to dealing with debt, it’s a good idea to take a step back and assess your financial beliefs. You may discover that some of your money attitudes or ideas are incompatible with your aim of getting out of debt.

The first step toward eliminating your problem areas is to recognize them. It’s also beneficial to have a clear awareness of where your debt comes from.

Debt is likely to be a problem for the ordinary American consumer because of:

- Loans for Mortgages

- Home equity lines of credit are a type of credit that allows you to borrow money against your

- Automobile Loans

- Loans for Students

- Using a Credit Card

- Loans for Individuals

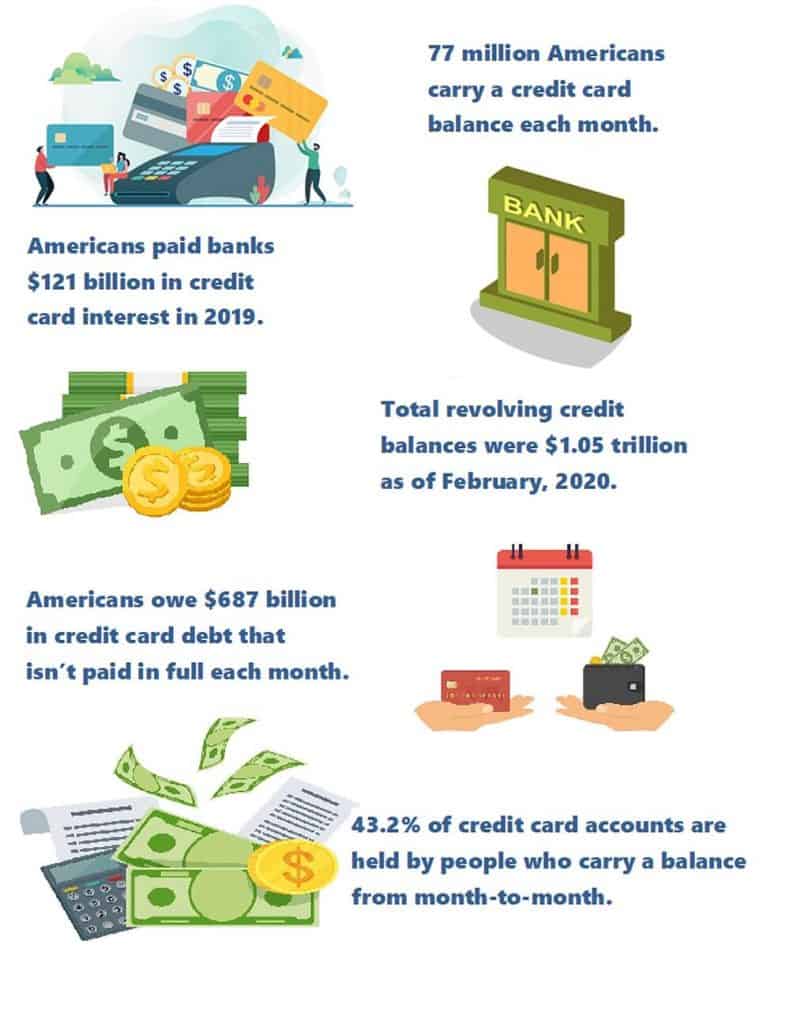

As millions of Americans battle with credit card debt, credit card overspending demands special attention.

(Source: Magnify Money)

People overspend for a variety of reasons, including unexpected medical bills, travel expenses, necessities, and a variety of other plastic purchases. Making merely the minimum credit card payments jeopardizes one’s financial well-being.

Step Three: Understand the Cost of Debt

"Every time you borrow money, you're robbing your future self," the saying goes.

Debt is expensive, and you will have to pay it off sooner or later. How much does it cost to be in debt?

Take a look at the following hypothetical scenario. You have a $26,000 debt with an 18% interest rate, and you pay the 3% minimum payment every month.

You will have paid $7,965 by the conclusion of your first year. After interest charges, your principal will be decreased by $3,982, resulting in a due total of $22,018.

You will have paid $26,443 at the conclusion of your fourth year, which is $443 more than your original loan amount. Your outstanding balance would remain at $12,778!

Step Four: Prioritize Debts

If you are unable to make your monthly debt commitments and must choose which bills to pay, the debt that your creditor is attempting to collect the most aggressively is not your top priority.

The roof over your head, your car, and your basics are your top considerations. Your top priority is secured debt. Defaulting on these types of loans can put these assets in jeopardy.

Follow this list of priorities instead.

- Cover your basic needs, such as food and unavoidable medical costs.

- Keep up with your rent/mortgage payments.

- Attempt to keep your utilities operational.

- Maintain your automobile loan and insurance payments if your vehicle is a necessity.

- Maintain a steady stream of child support payments. You could go to jail if you don't make these payments.

- Make sure you pay your income taxes.

- Make sure you're on top of your student loan payments.

- If you don't make these payments, you could lose out on tax returns and other federal advantages.

- Unsecured debts, such as credit card debt, should be addressed.

Step Five: Make a budgeting plan and select a budgeting system.

In three ways, a spending plan will assist you in getting started with your credit card debt relief.

- It will provide you with piece of mind and help you develop good spending habits.

- It will reveal just how much money you have available to pay off your debts.

- It will also tell you how much money you’ll need to finally get out of debt.

Getting a budgeting system up and running could be as simple as picking up a pen and some paper. You can also utilize spreadsheets or dedicated apps to assist you. Divide your spending into three groups.

- regular monthly costs (such as your mortgage or rent)

- Committed expenses that are subject to change (like groceries and utilities)

- Expenses not covered by insurance (gym memberships, cable service, cell phones, etc.)

Step Six: Seek professional assistance and decide on a debt relief plan.

Whether or if you require expert debt resolution assistance is determined by your present financial condition. Make a list of the questions you wish to ask.

- Do you rely on credit cards to bridge the gap between your monthly expenditure and income?

- Do you pay the bare minimum on your credit cards or make late payments?

- Have you ever “juggled” credit cards by opening new ones and shifting sums between them?

- Are you being harassed by debt collectors?

- Have you recently seen a major decline in your income?

- Do you budget with credit cards in mind?

- Do you use credit to purchase necessities?

- Have your credit cards been maxed out?

If you answered "yes" to more than a few of these questions, you will almost certainly want professional debt reduction assistance.

Call 888-254-3702 to speak with a Cardinal Law Center Certified Debt Specialist about the best debt relief options for you.

Cardinal Law Center Can Help

You are not required to complete all of these tasks by yourself. Each of these steps can be assisted by Cardinal Law Center. Our Certified Debt Specialists can talk with you about your present financial position and help you figure out the best course of action for getting out of debt in a reasonable amount of time. You can realistically defeat debt with enough diligence, perseverance, and assistance.

Take immediate action to minimize debt-related stress from your life. Get a customised debt relief plan immediately by calling one of our Certified Debt Specialists.

Related Pages

If you’re sick of debt and the restrictions it places on your life, you’ll need to devise a strategy to drastically improve your financial status. Here are a few debt-reduction solutions for you:

You have a variety of debt-resolution choices depending on your financial position. Cardinal Law Center can assist you in determining which choice is best for you.

Have you noticed that the majority of your money appears to be going toward credit card interest, and the needle on your balance due never seems to move in the correct direction?

Begin Your Personalized Debt Relief Plan Right Now!

I appreciate all of your assistance in resolving my debt, and I've been speaking Cardinal Law Center's praises since the beginning. You guys have gone above and above my expectations, and I've already referred you to a few others I know. Thank you very much for everything!