Which Debt Relief Option Is the Best?

If you’re sick of debt and the restrictions it places on your life, you’ll need to devise a strategy to drastically improve your financial status. Here are a few debt-reduction solutions for you:

- Debt reduction by do-it-yourself (DIY)

- Planned debt repayment (DSPs)

- Credit counseling and a debt management plan can help you get out of debt.

- Bankruptcy Loans for debt consolidation

We understand that deciding on the best debt relief option can be difficult, especially when you are already struggling with the stress that debt brings. That’s why we suggest speaking with a Cardinal Law Center Certified Debt Specialist, who can help you figure out which of these solutions is best for you.

Here’s a quick rundown of what each debt relief option entails.

You Can Get Out of Debt. Yes, You

Get a personalized debt relief plan today.

Do It Yourself Debt Reduction

You might be able to pay off your debt on your own if you can:

- You have a reliable source of money.

- You’ve made all of your payments on time.

- On your credit cards, you can pay more than twice the monthly minimum.

The Snowball Method is attacking the credit card with the smallest balance first, while paying the minimum on the others. You can retire one card at a time this manner. According to the Avalanche Method, you must first pay off the credit card with the highest interest rate.

DIY debt relief has the advantage of not affecting your credit score and costing nothing more than what you owe plus interest. The negative is that you may find yourself making little progress toward your debt-free objective. If that’s the case, you can always talk to a Cardinal Law Center Certified Debt Specialist about your circumstances and alternative choices.

Debt Settlement Plans (DSPs)

For consumers who owe more than $10,000 in unsecured debt, such as credit cards, debt settlement plans are typically a reasonable alternative. A debt settlement plan can help you get back on track if you’re having trouble making the minimum monthly payment on your credit cards or making little to no progress on paying off the principle amount of debt you owe.

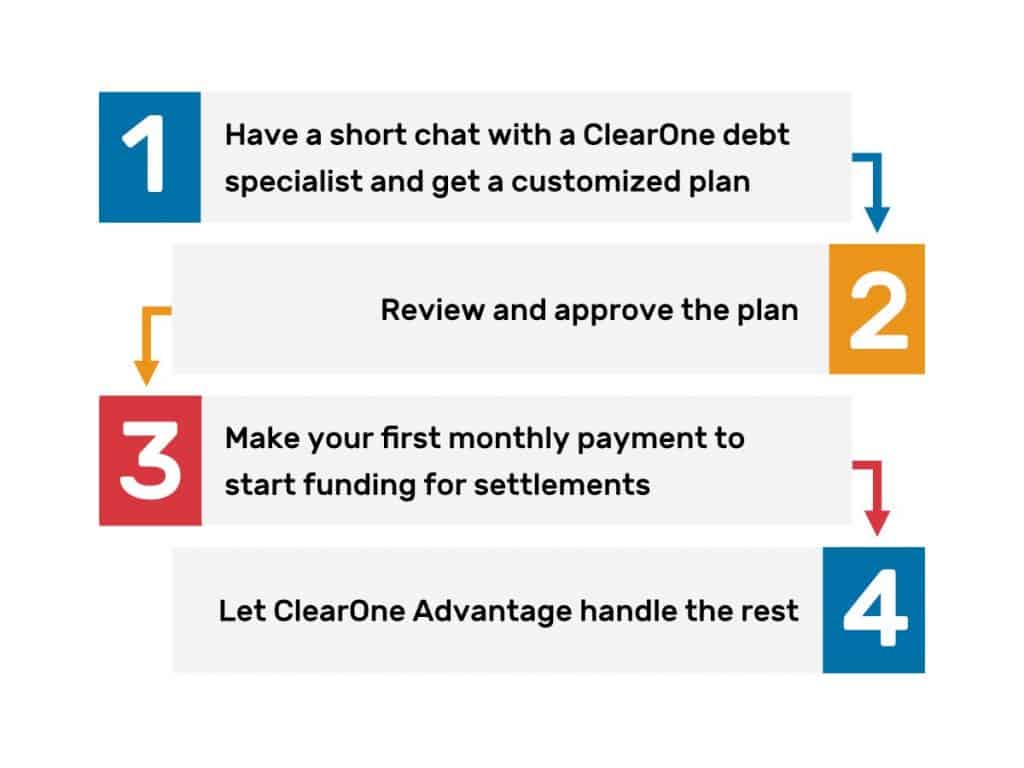

We perform all the heavy labor for you when you choose a debt settlement plan with Cardinal Law Center. The following is how it works:

- Creditors often agree to accept less than you actually owe when you use a Cardinal Law Center DSP to settle your debt.

- There are no upfront fees, unlike with some other sources of debt relief. Fees are only collected if Cardinal Law Center has reached an agreement with your creditors. Can be used to pay off unsecured debts other than credit cards: A DSP can be used to pay off a variety of unsecured debts, which means you can pay off the majority of your obligations with just one plan and a single monthly transfer to your escrow account.

- You are the owner of the escrow account: For the duration of the debt settlement process, you have control over the FDIC-insured account.

- In 2–5 years, you’ll be debt-free: By making all scheduled deposits and following a tailored DSP, Cardinal Law Center customers can be debt-free in as little as two to five years.

- DSPs have a proven track record of assisting clients in getting out of debt: According to a research by the American Fair Credit Council, debt settlement saves on average $2.64 for every $1 spent on fees.

- Some creditors may refuse to settle: While many creditors will agree to a settlement with you, some creditors may refuse to accept your offer.

- Your credit score will suffer as a result of this: Debt settlement has a negative influence on your credit score, although it is not as bad as bankruptcy.

- Tax implications: You may have to pay more taxes on the money you save by settling your debts.

Find Out More The Process of Debt Settlement

We understand that getting out of debt and regaining control of your finances involves both determination and commitment on your part. Our clients’ past success, on the other hand, has shown that you can overcome your debt.

Debt Management Plans and Credit Counseling

Credit counseling/debt management is a type of debt consolidation that may be beneficial for persons with unsecured debt of $5,000 to $10,000. It enables you to consolidate various credit card obligations into a single payment, resulting in cheaper interest rates and possibly waived penalty fees.

Credit counseling may have a minor negative influence on your credit score, and there are certain upfront and ongoing expenditures to consider.

Bankruptcy

Bankruptcy should only be considered as a final resort for those who have exhausted all other options. An automatic stay protects you from creditors for the duration of the bankruptcy proceedings if you file successfully.

However, filing is hard, and you will almost always need to consult with a bankruptcy attorney, who will charge you fees. Even if your bankruptcy is approved and you are able to discharge part or all of your debts, the negative influence on your credit score will persist for 7-10 years.

Is Bankruptcy a Good Choice for You?

Bankruptcy should only be considered as a final resort for those who have exhausted all other options. An automatic stay protects you from creditors for the duration of the bankruptcy proceedings if you file successfully.

However, filing is hard, and you will almost always need to consult with a bankruptcy attorney, who will charge you fees. Even if your bankruptcy is approved and you are able to discharge part or all of your debts, the negative influence on your credit score will persist for 7-10 years.

Debt Consolidation Loans

Debt consolidation loans are designed to replace several high-interest credit cards with a single low-interest loan. This allows them to combine your monthly payments into a single payment with better conditions. People with good credit may be eligible for these loans.

Payment terms for debt consolidation loans range from 36 to 60 months. The primary risk of “paying off one debt with another” is that you may be tempted to re-use your previously paid-off credit cards. Another concern is that, because certain debt consolidation loans are secured, you risk losing assets used as collateral if you default on the loan.

Get More Information about Debt Consolidation Loans

You are not alone if you are continually concerned about how to make your next credit card payment. Approximately 80% of Americans are in debt. You don’t have to be a spendthrift to find oneself in this situation.

Is Debt Relief a Good Option for You?

A Cardinal Law Center Certified Debt Specialist will assist you in determining if debt settlement is the best option for you, as well as putting together a personalized solution to match your needs. Get out of debt in a wise way. Find out how to do it.

Related Pages

You have a variety of debt-resolution choices depending on your financial position. Cardinal Law Center can assist you in determining which choice is best for you.

If you’re sick of debt and the restrictions it places on your life, you’ll need to devise a strategy to drastically improve your financial status. Here are a few debt-reduction solutions for you:

Have you noticed that the majority of your money appears to be going toward credit card interest, and the needle on your balance due never seems to move in the correct direction?

Begin Your Personalized Debt Relief Plan Right Now!

I appreciate all of your assistance in resolving my debt, and I've been speaking Cardinal Law Center's praises since the beginning. You guys have gone above and above my expectations, and I've already referred you to a few others I know. Thank you very much for everything!